Tapiwanashe Mangwiro

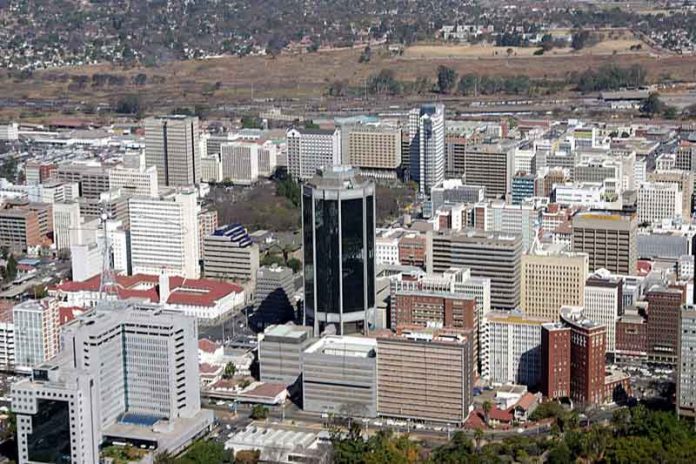

HARARE – The ministry of Finance gazetted a new statutory instrument, which deals with fund administrators, principal officers, registration fees as well as financial results of pension funds.

For a person to be a fund administrator according to SI 91 of 2020, one has to be an insurer registered with the commission and if not registered they have to be registered as a company in terms of the Companies and other business entities act. The company’s sole purpose should be to provide administrative services to pension funds.

The company should also have at least five shareholders with no individual or their relative owning more than 40% of voting shares of the administrator. In terms of capital, the company should have a minimum unencumbered capital of $1.5 million.

For the company to qualify as a fund administrator it must make sure that it has the professional and technical capacity, and adequate operational systems as directed by the Commission to perform the functions of a fund administrator.

Persons that seize to qualify to be a fund administrator on the issuance of the new SI will be given a period of 12 months to put their house in order for them to qualify as they continue to be administrators. Only after the 12 months will they be disqualified if they do not meet the new conditions.

In terms of the principal officer, one can only be appointed by the board of the fund and the chairperson of the board of the fund is not allowed by the new regulation to be appointed as the principal officer.

The SI also has the new registration fees for fund administrators and pension funds. For a provisional registration of a fund one has to part with $4 000 and in order to renew the provisional fund a fee of $2 000 is to be paid.

In order to register a pension fund $4 000 is needed and for any amendments of registration of a pension fund, $2 000 is the new fee. Amalgamation or splitting as well as the transfer of a pension fund to be sanctioned a fee of $5 000 is to be paid.

In respect of each amendment to the rules of a pension fund and for each copy of a certificate of registration the fund will have to pay $2 000 and $1 000 respectively. $600 is to be paid in order to get a certified copy of the rules of the fund.

Group umbrella scheme registration fees were also reviewed to $2 000 and another $2 000 for every participating employer. $2 000 is also to be paid in order to register a group life scheme. In order to be a fund administrator the individual or registered company have to part ways with $11 000 as per SI 91 of 2020.

Additionally the SI noted that fund administrators should within six months after the end of the financial year prepare financial statements sent to the commissioner with signatures of the principal officer of the fund.

A return in Form P.P.F.R. 7 relating to their operations during the financial year to which the return relates to audited financial statements, cash flow statement in which they have been instructed to use the direct method.

Also part of the form should be a list of the directors and top management, a schedule of all funds administered by the administrator, listing all participating employers under each fund as at the end of that financial year and a schedule of all funds registered or dissolved during that financial year.

A schedule of all participating employers registered or dissolved during that financial year and a schedule of debtor’s aged analysis should also be attached in the P.P.F.R 7.