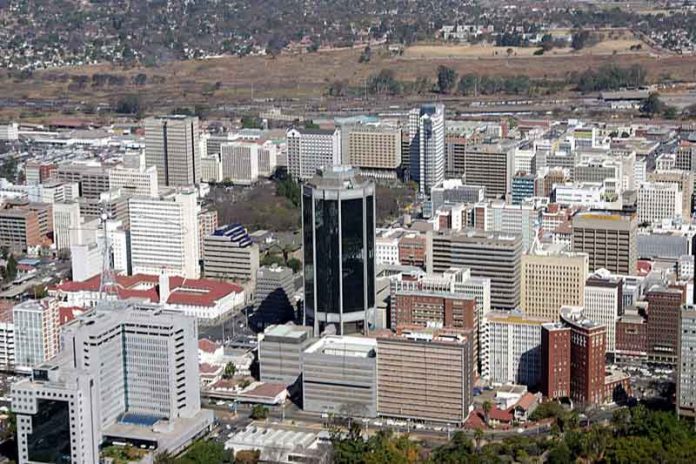

HARARE – The property market in Zimbabwe is likely to see an increase in voids and occupancy rates in the different properties sector, according to Integrated Property’s Q1 2020 report.

According to the report, the Office sector was affected in the first quarter mainly due to the Covid-19 pandemic. The sector already has void rates as high as 60% and low rental yields for CBD office space but high occupancy rates and rental revenues have characterized the office parks around the country.

Rentals in the sector have reduced to as much as US$5-US$6 per square metre and Integrated Property believes the sector will see an increase in voluntary space surrenders as a way to cut operational costs due to tight cash flows. The sub sector is likely to fill the pinch of the Covid-19 pandemic into Q2 2020 and maybe ease out Q3 2020.

The most resistant sub sector is the retail which has seen consistent occupancy rates of above 90% even during economic down times. Rentals in the sector due to competition have remained high around US$15-US$20 per square metre. However Covid-19 has caused pain the sector as majority of the occupants are in the informal sector and are not allowed to trade during the lockdown period.

For those who are trading, restocking had been a problem with boarders closed due to the pandemic. This leaves the sector vulnerable to huge losses in revenue because only the few giant retailers will be able to meet rental requirements and this will be a short term problem according to the report.

Just like the office sector, with production capacity at 30% the industrial sector continues to experience high void rates and low rental yields. Rentals in the sector have managed to maintain the US$1.50-US$3 per square metre despite the void rates. Prediction is that if Covid-19 impact increases a drop in demand for industrial space will be witnessed.

Integrated Property reported that mortgage loans from December 2017 constituted an average of 12-14% of the total productive sector lending. From June 2019 after SI142 of 2019 the percentage fell from 19.54% to 5.65% in December 2019. This is due to high inflation in the economy which has let mortgage real returns in the negative and prompted banks to adopt a more cautious lending approach. With interest rates reducing further banks might opt to reduce mortgage lending even further in order to minimize losses.

The residential sector continues to react to reduced disposable incomes and affordability challenges affecting tenants. With the Covid-19 pandemic lockdowns, tenants will lobby for lower rentals and this might persist in the short to medium term. Student accommodation was also affected by the virus as universities have remained shut. However this is temporary and the sector continues to be a lucrative one going forward.

The country has only eight major construction projects, with four in the private sector and the other four in the public sector. This is a concern as the country needs more infrastructure and according to CIFOS 2019 the industry is operating below the 30% mark. Public Private Partnerships have been touted as being in shortage in the country but these have been affected by foreign currency shortages, exchange rate induced inflation and lack of funding among other things.

With the Covid-19 disruptions, most projects will be postponed as some will be cancelled altogether. However there were no major movements in property values in USD terms from the previous quarter where property prices adjusted downwards by a 20-30% margin as the year 2019 closed.

On property valuations, Integrated Property said, “It is imperative to note that market values are dependent on the future benefits which include right to use, occupy, enjoy and rental income. Commercial property values are dependent on the rental cashflows, as such the organizational capacities to pay rentals will be compromised which will affect property values.”

In this regard, property values for commercial properties will decline in the short term as a result of distorted cash flows and disrupted rental incomes owing to restricted operational activity especially for the retail sector which is largely dependent on imports from China.

The report urged landlords to engage their tenants on how they can structure rentals, as the sector depends much on rental revenues and that is the only way void rates will be kept at a minimum.