Happi Zengeni/Tinashe Nyamunda

Zimbabwe has spent at least half its fiscal existence using temporary cash, other people’s cash with additions, facing cash shortages, counterfeiting its own currency and generally providing collectors of notes and coins with a wide range of product.

There were problems from the very start.

When Cecil Rhodes contracted Franck Johnson to recruit and lead his “Pioneer Corps” to the “region around Mount Hampden”, young Johnson, who called himself major without a Queen’s commission, saw this as an opportunity not just to make a profit on the 87 500 pound contract but also make a bigger one on arrival by milking his force, partly through currency manipulation.

The pioneers took only modest sums with them, in their pockets as it were, but Johnson had 5 000 pounds in gold sovereigns and half sovereigns. On arrival on 11 September 1890 they had to build Fort Salisbury, but this was all finished on 30 September and they were then paid, by cheques drawn on Standard Bank of Mafeking.

However, Johnson, and his two more senior officers, had brought extra wagons and had set up temporary headquarters on the western slope of the Kopje as Johnson, Heany and Borrow with all the spades, picks and other supplies a newly arrived miner could desire. The lack of cash was not a problem. Johnson would cash the pay cheques from his gold coin hoard, so that they could immediately give him back the coins as they bought stuff.

The British South Africa Company Police were just paid by cheque and other expenses of the company were also paid by cheque, signed by new administrator Archibald Colquhoun and also drawn on the nearest bank, Standard Bank of Mafeking. This quickly resulted in cheques passing from hand to hand as currency, and there are a lot of funny tales of people going to buy potatoes, or a bottle of brandy, with a cheque for say 1 pound 17 shillings and four pence, and getting change in boots.

Hugh Marshal Hole, the Civil Commissioner for Bulawayo, explained his challenges in trying to purchase commodities at an auction on behalf of a club in which he was a member. With a BSAC cheque of £5.3s.4d., he bought a bag of potatoes for 17s. for which the

auctioneer gave him a pair of second hand boots valued at £2.10s., and a bottle of Cape Brandy for £1 as change because the cheque was indivisible and there were no coins. To settle the balance Hole was offered “the choice of another bottle of brandy or a doubtful cheque of £.5s. As this case illustrates, instead of a smooth assemblage of Cape and British sterling, even the early settler communities themselves settled for barter.

Eventually, about 18 months later, Rhodes made a deal with Standard Bank, giving them a 20 year monopoly so long as they opened branches in his new territory. So in May 1892 John Boyne, the new manager, and Wilfred Honey, the new accountant of the first branch rode into town with a Gladstone bag holding 3 000 pounds in notes and coins, with provision now made for regular shipment by secure mail. Admittedly Honey had to sleep in the makeshift banking hall, one of the two offices in a crummy building assigned to the bank, with the bag as his pillow until the sage arrived. But the people of Fort Salisbury could now cash cheques, and a lot of personal cheques turned out to be dud, and get cash in notes, gold and silver.

In 1896, an economist named W. Fosciety suggested this idea to Cecil John Rhodes as

beneficial to the settler society of the new colony. Fosciety saw the establishment of a local

bank of issue, mimicking in many ways, the Bank of England, as a solution to the problem of coinage issue. His suggestion came at a time when there was no mint for coinage in the

colony, but he viewed it as laying the foundations for establishing, not just a bank of issue,

but an autonomous institution that would not require the involvement of London

Fosciety also believed that the State and Public Bank would regulate the printing of notes and curb the ‘hoarding’ of coins and their smuggling to South Africa.

Fosciety however admitted that it would be difficult at first to fix a strictly convertible currency. It would not be determined by legislative enactment but the natural laws of equilibrium would decide an approximate amount. The difficulty would be reduced if the Chartered Company was represented on the board of such a bank. Fosciety seems to have been a little far sighted as he made these suggestions in a colony that was less than seven years old. He even foresaw the establishment of a mint in Southern Rhodesia and the passing of an Ordinance that would compel that the State Bank to give bank notes for all gold brought in. The price, designed to support the gold mining industry, would produce a profit of “£3 7d. 9s per ounce of … pure gold”, just as in the case of the Bank of England

Standard Bank expanded as Rhodes expanded his little empire and soon had branches in all main centres. From 1896 the bank even started issuing its own notes, at par with sterling which was the legal currency, although the odd Transvaal “ponds”, identical in size and eight with a sovereign, also circulated. So there was a mixture. Notes were more popular than the little 8g sovereigns or 4g half sovereigns, which could be lost if there was even a small hole in the pocket, and the silver coinage was a boon.

Come the Boer War, and the railway and road from the south were cut. Small change dried up. Marshal Hole, one of the very few bright men in the administration, had a solution. The BSA Company had a mania for printing stamps, possibly thinking its settlers would be writing letters every day, possibly because it wanted to make money from selling these to collectors. Anyway from the huge stocks available Hole made temporary small change by sticking a stamp on a specially printed square of cardboard, signing it and then getting the bank to issue it when people needed small coins. It worked and they were redeemed after the war when bags of coins flowed north again.

In promoting the use of “Marshal Hole notes,” the company-government acted as a quasi-

monetary authority and in a way, the issue of currency stamps had shown how a monetary

sector controlled by the government could guard against such problems as coin shortages.

However, the Company government performed those activities without an empowering

legislation. This reality, together with the persistent problem of coin shortages was a crucial

factor necessitating the drafting the Banking and Note Issue which had gained much traction at the opening of the first Legislative Council meeting in the country in 1899

Everything now puttered along, with Barclays Bank’s subsidiary, Barclays Bank Dominions Colonies and Overseas, setting up office in 1912 as the Standard monopoly expired, and issued its own notes. In 1923 The Union of South Africa started having its notes printed in Britain and coins minted on Paul Kruger’s old mill in Pretoria, but by the Royal Mint. So sterling currency, private bank notes, South African notes and coins from Britain and South Africa all circulated. This was not a bad as it sounds since everything was denominated in sterling, could be swapped for sterling at par, and even the coins looked almost identical, with just a tiny SA stamped on the Pretoria coins which otherwise used British dies.

There was a minor problem from 1931 when Britain went off the gold standard, to 1933 when South Africa followed, because the SA pound was worth more than sterling, but Southern Rhodesia stuck with sterling and the country became almost mono-currency. On 28 September 1932, Henry Birchenough of the British South Africa Company wrote to the Rhodesian Prime Minister stating that it was his company’s “feeling that Southern Rhodesia being a primarily exporting country, it is to its interests and that of the railways which depend so largely on the export to follow sterling as Northern Rhodesia…is doing.

From 1932 permission was granted for Southern Rhodesia to start issuing its first currency, halfpennies and pennies. Bigger stuff was still British and South African. But this was the origin of the penny with a hole in the centre. The first batches, issued from 1933, were of cupro-nickel and so looked silvery, and so perhaps the hole avoided confusion with the real silver coins from a 3d upwards.

In 1938 the Southern Rhodesian Currency Board was established, in a set of events that brought down the Government and resulted in a General Election. Godfrey Huggins was running a minority Government with support from a small Labour Party on confidence and supply. The board’s small office needed an Act of Parliament to be built. The Labour leader checked the members in the Assembly just before the final vote, saw there was a Huggins majority of one, and went to the bar instead, just a few second before an opposition member raced in, and voted no. As the matter was technically a financial matter, it was a confidence matter, and Huggins lost, resigned, called an election and won with a huge majority.

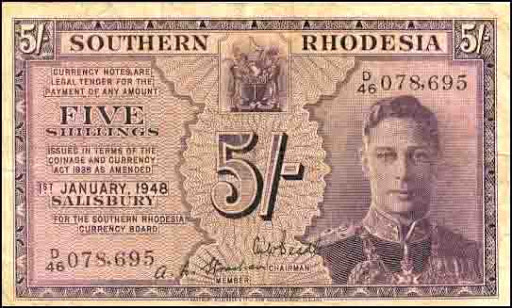

The board could print notes but had to do this in London, and had to keep on deposit with the Bank of England the exact amount as the total face value of its notes, which were on par with sterling. This cut costs and gave Zimbabwe its first currency, with Northern Rhodesia and Nyasaland joining in 1940 as war made deliveries of sterling dubious. But small change struck again, and the board issued 5 shilling notes from 1943 to fill the gap.

The board, now the Central African Currency Board carried on into Federation issuing its first federal notes in 1955 to replace the Southern Rhodesian notes. But in 1956 it became the Bank of Rhodesia and Nyasaland, a real reserve bank, and could if it wished print what it liked. But printing was still in Britain and there were people watching, so it just printed what was needed and had coins minted. By this stage, throughout the empire silver coins had been withdrawn and replaced with cupronickel or the same weight but slightly thicker. The pennies had already been turned to bronze, although the older “silver” pennies still circulated as unlike the real silver coins were not precious metal nd so were not melted down.

Things ticked along, the end of Federation was announced in advance so the new Reserve Bank of Rhodesia could have new notes ready, printed in London, on time although Federal stuff still circulated until handed in to a bank.

UDI threw a spanner into the works, since no notes from London. Banknotes became grubbier and the repairs were repaired. This was seriously filthy lucre. But Ian Smith was on the ball and a banknote press was smuggled out of Germany. One dark night a collection of white bricklayers was assembled outside the old redbrick Reserve Bank building, in the alley at the back, a section of wall was removed, the press was shoved in, and the wall bricked up by dawn. No one from MI5 knew. A few weeks later the first locally printed notes hit the banks. The design and colour was similar, but enough changes were made to make it clear that Rhodesia was not counterfeiting its own currency, although technically it was.

New coins had already been issued in the 1960s, with values in both cents and shillings and pence, and with decimalisation the old penny finally died, and new ordinary bronze copper cents took over, with the banknotes keeping their counterfeit design and colour but the decimal dollars instead of pounds. With Smith’s Republic the Queen’s face went to be replaced by the coat of arms although the watermark was still Rhodes.

Independence was not a problem. The new Reserve Bank of Zimbabwe had the press, changed the design slightly to change the name, changed the coat of arms and changed the watermark. But Zimbabwe was producing its own notes very quickly and new coins, in the smaller Rhodesian Republic designs but with new coats of arms and names were commissioned.

Then came Gideon Gono, hyperinflation, sanctions on banknote paper and the like. Gono got round the fact that his coins were trash and his notes not even small change by printing bearer cheques, of ever increasing denomination, followed by new proper banknotes when he lopped a lot of noughts off the currency and reissued the old coins with the new value. But hyperinflation accelerated so the new notes had to be supplemented by ever larger notes, until he hit $100 trillion dollars and the whole currency collapsed.

But even with his presses, now based in Msasa, howling day and night the inflation was so bad that huge shortages of notes appeared, and people would stop off at a supermarket before going to a bank to get a plastic shopping bag to carry their money home if they could get money. It usually took longer to count the notes at a shop till than buy the stuff in the first place.

In the new age US dollar notes, but no coins, and Rand notes and coins circulated instead. The rough initial exchange rate of R10 to US$1 gave rand coins the role of small change, but not for large amounts since the exchange rate fluctuated, at times all rand coins were hoarded and taken south. So small change was a perpetual problem causing a lot of prices to be rounded off into whole dollars. The growing use of debit cards and money transfers helped, but prices for a surprising number of small items were higher than they should have been.

Finally Zimbabwe issued its own coins and small notes, the bond coins and notes, to circulate with the US dollar notes. This gave small change and allowed the worst of the very tatty and dirty US$1 notes and US$5 notes to go into retirement, but few made large transactions with the new cash, until of course the Government started restricting the supply of US dollar notes, and then declared the old bond note the new Zimbabwe dollar, followed by a slight change to the printing plates to remove the words “bond note”.

Small change we now had, and for some time no big notes. The RBZ did not want cash transactions, as it said it could track and monitor all moderate to large transactions when these must be transferred or no mobile money. But, as we all know, there are those who carried bags of $5 notes around. Now the RBZ will put new notes of higher denominations into the market, which has been predictably welcomed by a run on the parallel market rates, signalling perhaps that currency instability is with us to stay.