Tapiwanashe Mangwiro

HARARE – Foreign Direct Investment (FDI) to Sub-Saharan Africa fell by 11% to US$28 billion in 2020 due to the Covid-19 pandemic, according to the United Nations Conference on Trade and Development (UNCTAD). This comes after the region’s major FDI destination countries were heavily affected by the ongoing pandemic, leaving investors with a conservative approach.

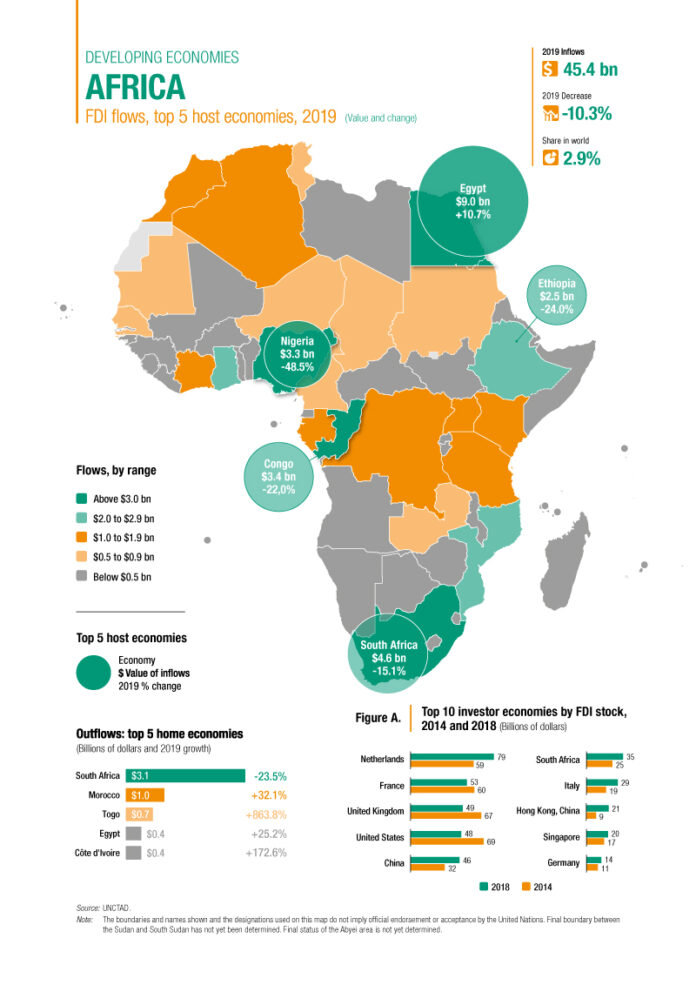

Zimbabwe’s neighbor in the south, South Africa saw FDI fall almost by 50% to US. kazino 5 billion from US$4.6 billion in 2019. The diversified country’s FDI was saved by few large projects which were announced including Pepsico’s US0 million in order to expand the capacity of Pioneer Foods and a US0 million announcement by Google for a fibre optics submarine cable. 777 casino

Nigeria’s FDI was heavily affected by lower crude oil prices and the closure of oil development sites at the start of the pandemic due to movement restrictions. The country saw inflows shrink to US$2.6 billion from US$3.3 billion in 2019.

At the horn of Africa, Ethiopia saw FDI decline by 17% to US$2.1 billion as significant investments were made in the manufacturing, agriculture and hospitality sectors. FDI in the country was affected by the pandemic and also by a conflict between them and Egypt and Sudan on filling up of the Nile Dam, which attracted significant international interest.

The US$20 billion Total led LNG project continuation helped Mozambique’s FDI balance as it saw its inflows contract by just 6%. The conflict ravaged nation saw its FDI fall to US$2 billion in 2020, mainly because the LNG project has not moved at the pace that was anticipated.

Not all countries saw a decline in FDI as Senegal was among the few economies with higher inflows in 2020. Despite the pandemic, the West African country saw its inflows increase by 39% to US. مسابقات للربح مجانا 5 billion due to increased energy investments.

Going forward in 2021, the outlook seems negative for FDI as UNCTAD forecasts a 5-10% slide in inflows around the world. This comes as the global economy is expected to initiate a hesitant and uneven recovery, with GDP growth, gross capital formation and trade are projected to resume growth in 2021.

If any FDI is to come, projections are that it will be in the form of cross border mergers and acquisitions, rather than from new investment in productive assets.