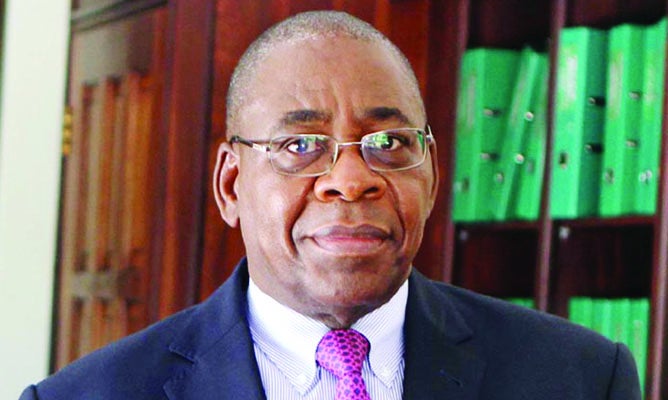

Davison Kaiyo

HARARE – Australia listed company, Invictus Energy has appointed leading business executive Joe Mtizwa as non-executive director and deputy chairperson of the board.

The appointment is effective immediately.

The former CEO of Delta Beverages, is the current chairperson of Mangwana Capital, a major shareholder of the company as well as a director of 100% owned local subsidiary Invictus Energy Resources Zimbabwe Corporation.

Invictus Energy MD Scott Macmillan said the company is pleased to have Mtizwa as deputy chairperson of the board describing him as someone with a track record of leading some of the country’s leading businesses.

“Joe’s appointment will strengthen the Invictus Board as a critical time in the company’s growth as we commence the ramp up of exploration program and operations in Zimbabwe,” he said.

Mtizwa served 10 years as group CEO of Delta Corporation until he retired in 2012. Delta is one of the biggest stocks on the Zimbabwe Stock Exchange (ZSE) by both capitalisation and revenue generation.

He sits on President Mnangagwa’s Presidential Advisory Council (PAC), which has helped the administration in crafting key economic policies since coming to power in late 2017.

He served on the Reserve Bank of Zimbabwe board from 2015 to 2019 and chairs the boards of ZSE listed sugar processor starafricacorporation and state owned Infrastructure Development Bank of Zimbabwe.

Invictus recently sign Petroleum Exploration Development and Production Agreement (PEDPA) with Zimbabwe. The PEDPA provides the license holder the right to enter into a 25-year production license following exploration periods.

The PEDPA also provides for Special Economic Zone (SEZ) status for the Cabora Bassa Project which will facilitate a host of fiscal and non-fiscal incentives over the life of the project including legal and fiscal stability, offshore banking, zero capital gains tax, tax holiday periods and 15% corporate rate thereafter.

The company also completed a significantly oversubscribed A$8 million capital raise via a share placement to new and existing institutional and sophisticated investors. The A$8m capital raise before costs through the issue of 72.7 million new ordinary shares at an issue price of $0.11 and an attaching 1 for 2 option at a strike price of $0.17 with an expiry of 3 years.

The company projects to start drilling in the third quarter of 2021.