Tadiwa Musiyiwa

HARARE – Zimbabwe Stock Exchange-listed property investment and development company, Mashonaland Holdings has increased revenue by 37% to ZWL359 million driven by new leases concluded during the quarter ended 30 September, 2021.

In a trading update, Company Secretary, Egnes Madhaka said the increase in revenue was a result of periodic rent reviews which the business had been performing in line with market practice. The improved revenue performance was also driven by new leases concluded during the period.

She said occupancy levels had increased to 80.6% from 79.2% recorded the same period last year.

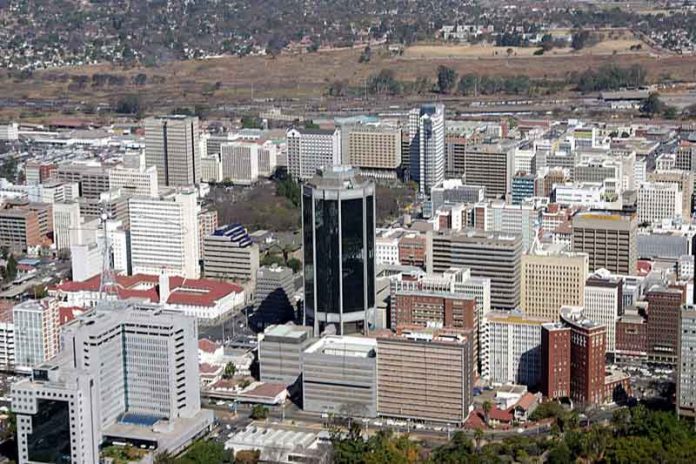

“The property market remains susceptible to low demand for space particularly in the CBD office sector due to low economic activity. The market has however recorded improvements in occupancies for the retail sector as the economy mirrors its retail concentration. The industrial sector has remained resilient with average yields of 8% across the market as well as occupancies above 90%”.

Madhaka noted that the residential sub-sector had been dominant, attracting new development activity following the high demand for residential space and also the low risk given the sizes of residential units.

During the quarter, the Group’s operating profits increased by 18% due to the revenue growth. The operating profit margin however decreased by 14% following an increase in total operating expenses.

“The increase in operating expenses was driven by movement in unofficial market exchange rates which had a bearing on the Zimbabwe Dollar value of maintenance materials and services consumed by the company” said Madhaka.

As a result, the company increased its investment in maintenance activities in an effort to retain occupancies and also to attract new lettings.

Madhaka said the development of the Mashview Gardens cluster housing project in Bluff Hill Harare was ongoing with construction activity in progress for delivery of the first batch of houses in the first quarter of 2022.

Project marketing was ongoing, and the company was in negotiations with a potential buyer for completed units.

Furthermore, the company has completed renovations at the Chiyedza House co-working hub and has opened the facility for leasing with effect from 1 September.

Madhaka said the company was planning to expand into other vacant floors in the building following increased demand from the market.

She said the company had changed its reporting date from 30 September to 31 December starting from the current financial period.

The company will therefore be presenting its audited financial performance for the 15 months ended 31 December 2021 in the first quarter 2022.

On the Zimbabwe Stock Exchange, the Property firm is currently trading at 419.25c with a year to date gain of 362.32% and a market cap of $7.8 million.

In June 2020, general reduction in economic activity resulted in constrained rental growth as it could not match inflationary pressures with the COVID-19 pandemic further denting tenants’ rent-paying capacity. However, the containment of the 3rd wave this year and the resultant easing of the lockdowns has seen an increase in economic activity in the sector.