Ryan Chigoche

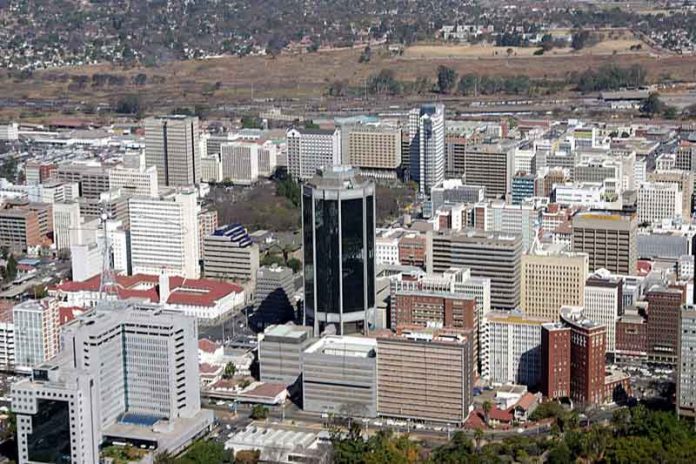

HARARE – The World Bank says the removal of tariff barriers alone will not see the country benefit enough from the Africa Free Continental Trade Area (AFCTA), with the bank highlighting the need to track non-tariff barriers such as regulatory barriers, and trade facilitation, in order to reap the full rewards of the trade agreement.

This development comes at a time when the local industry is currently fretting over the coming in of AFCTA which will have various goods from the 54 member countries entering the borders duty-free, directly competing with local products.

Zimbabwe’s manufacturing sector is in decline with capacity utilisation is in decline, dropping to 53.1% in 2023 owing to increased power outages, foreign currency challenges, and inconsistent economic policies which translates in a further decrease in sectorial investments and uncompetitive pricing.

The AFCTA which is already partially in operation is expected to benefit all member countries through imports and exports through the removal of tariffs.

Local industry desperate for survival are lobbying the authorities to ease the cost of doing business so that local products can defend its local market share and also compete once exported.

Speaking at the just concluded CZI Annual Manufacturing Survey, World Bank’s Economist at the Zimbabwe Office Victor Steenberg said for Zimbabwe to reap the benefits, removal of tariffs won’t be sufficient, emphasizing the need to focus on non tariff barriers to trade.

“‘So tariffs only will not see that big of an impact on exports. Tariffs and non-tariff barriers removal lead to a 25% impact on exports. But it’s really the combined effect of tariff removals, non-tariff barriers, and trade facilitation that will really improve the competitiveness of Zimbabwe’s private sector, and we’ll see it benefit the most from the AFCTA.

‘….tariffs are a necessary but insufficient component. So there’s a need to really focus on monitoring non-tariff barriers in the region, and then quickly identify and resolve them.

“And that allows you to really reduce some of these regulatory barriers. On trade facilitation there is need for automated electronic customs clearances, accelerating some of these processes, as well as implementing a simplified trade regime for small-scale traders.

“Then finally there’s a need for more consistent push on policy reform,” Steenbergen said as he reaffirmed the bank’s support to Zimbabwe towards implementation.

Despite the issues raised, once fully operational the AFCTA has the potential to boost trade across all sectors for the country. The World Bank is predicting a massive increase in exports and imports for agriculture, for industry for the AFCTA over a non-AFCTA level.

On the tariffs currently faced by Zimbabwe on the AFCTA markets by sector, minerals, food, and chemicals currently see the highest tariffs, and the move to the AFCTA will see a significant reduction in these tariff lines presenting opportunities for Zimbabwe.

“Agriculture and agro-processing really are where the biggest potentials for Zimbabwe are in the near future. That’s where there’s a lot of demand from neighboring countries, and that’s where Zimbabwe really could shine,” Steenberg said.

He added that the troubled manufacturing sector also has big potential particularly in the textiles and apparel , processed food, other manufacturing sectors, wooden and paper production, even chemicals and rubber.

For Zimbabwe, a 4.2% increase in new jobs emanating from the agriculture, construction, trade services, and the other sectors is expected, with wages also tipped to spike by 14% .

Recently the Competition Tariff Commission outlined a three tier tariff offer in line with the AfCFTA phased approach to tariff reduction.

According to the schedule, Category A accounts for 90% of the items with a five-year tariff phase-down period (2021-2025). As a result of the AfCFTA agreement, Category A goods will begin trade duty-free next year.

These are primarily general items, such as animals and selected manufactured goods. Category B accounts for 7% of all commodities, and tariffs will be phased down over a 10-year period beginning next year and ending in 2035.

This group includes commodities from various value chains that are supported by the government. Items from strategic value chains include iron and steel, leather, and cotton.

This suggests that by 2035, approximately approximately 97% of local commodities in the tariff book will trade duty-free. On the one hand, Category C accounts for three percent of the exempted items that would not be able to be traded duty-free in Zimbabwe under the AfCFTA. Examples include firearms ammunition, soya, bread, and traditional and cultural products.