Talkmore Gandiwa

HARARE – First Capital Bank has announced the closure of its Harare Street branch effective September 21, 2024.

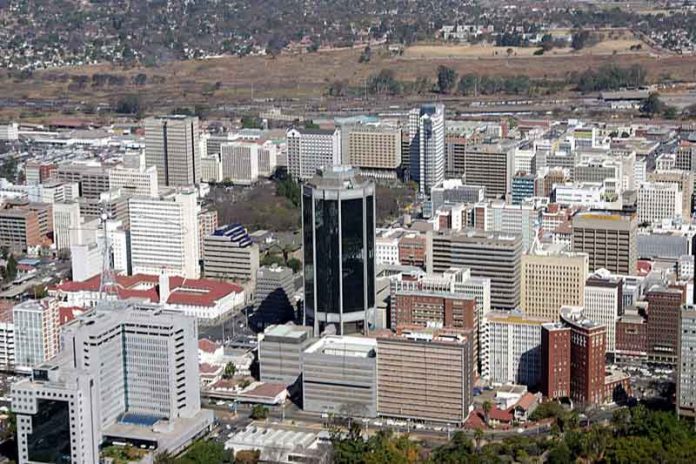

This will be the second First Capital branch to close in Harare this year. In a notice, the bank stated, “We write to inform you of the upcoming closure of our Harare Street Branch on Saturday, September 21, 2024. The last day of operations at this location will be Saturday, September 21, 2024. Effective Monday, September 23, 2024, your account(s), bank mandates, and indemnities will be transferred to and managed at our First Street Branch, currently located in the central business district at the corner of First Street and Jason Moyo Avenue.”

Meanwhile, the bank has reported a 168% increase in profits for the first half of the financial year, driven largely by the acquisition of an additional US$20 million in credit lines to bolster local industry.

In its financial performance report for the period ending June 30, 2024, FCB Chairperson Patrick Devenish highlighted the bank’s strong results. The bank achieved a profit of ZWG155.5 million, equivalent to US$11.5 million, for the six months ending June 2024.

This represents a significant improvement from the ZWG58 million posted during the same period in 2023. Earnings per Share (EPS) surged to ZWG7.19 cents (US$0.53) from ZWG2.70 cents (US$0.20) the previous year.

Devenish noted that the bank’s capital remains robust, consistently exceeding the regulatory minimum of US$30 million. At the close of the period, FCB’s capital stood at US$59.2 million, with a capital adequacy ratio of 31%, indicating a strong capacity to underwrite additional business. The liquidity ratio was also well above the regulatory threshold of 30%, ensuring the bank’s ability to navigate market fluctuations.

Total deposits increased to ZWG1.9 billion (US$137.1 million) as of June 30, 2024, a 12.5% rise from ZWG1.7 billion (US$123.1 million) reported on December 31, 2023. This growth reflects a rebound after a slight dip in the first quarter, attributed to earlier currency instability that eased following central bank interventions.

Foreign currency deposits made up 83% of total deposits, down from 87% at the end of 2023, signaling a gradual revival of local currency activity. Loan quality also improved, with the nonperforming loans ratio decreasing from 8% to 3% over the six-month period, and a loan loss ratio of 1.4 recorded.