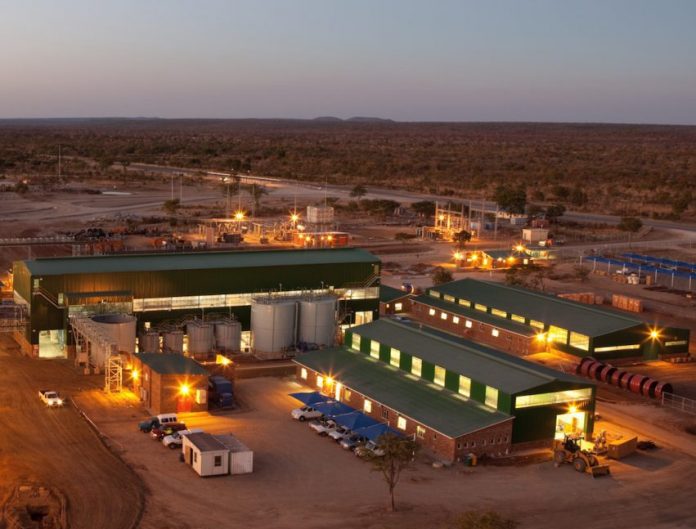

Zimplats, Zimbabwe’s largest platinum group metals (PGMs) producer, has invested over US$12 billion since FY2003 to expand and modernise its mining operations, and this substantial investment has been crucial in driving the country’s PGM industry.

Since 2003, the company has invested more than US$12 billion in Zimbabwe’s platinum group metals (PGMs) industry, with the majority of the funds going towards the purchase of essential mining equipment, materials, and services, as well as major capital projects aimed at increasing production capacity and improving operational efficiency.

Zimplats’ commitment to reinvesting in its operations has not only helped Zimbabwe’s economy, but it has also cemented its position as a global PGM market leader.

Zimplats’ annual report for FY 2024 shows that the company spent US$5 837 million on procurement, US$2 547 million on capital expenditure to expand and maintain operations, and US$1 983 million on government payments (income tax, additional profits tax, royalty, customs duties, pay-as-you earn, and withholding tax). In addition to the US$513 million loan repayment and the US$799 million dividend payment, employment costs received an 8% refund totaling $1 034 million.

The total cash utilisation (FY2003 – FY2024) amounted to US$12.7 billion.

Zimplats is currently undertaking US$1.8 billion in capital expenditure initiatives, which include smelter expansion, the construction of an extra concentrator, and the establishment of a solar power plant.

According to the report, investment in capital projects increased by 44% year on year to US$439.5 million in FY2024 due to the company’s capital expenditure on SIB, mine replacement and expansion, as mining, processing and environmental projects were advanced to replace depleting mines, increase processing capacity through the construction of a 38 MW furnace and associated SO 2 abatement plant, and complete the first phase of the planned 35 MW AC solar project.

Expansion capital surged by 105% to US$199.2 million (FY2023: US$97.1 million) as spending on the smelter expansion and SO 2 abatement plant accelerated, totalling US$181.5 million for the projects during the year. As of June 30, 2024, the cumulative investment in this project was US$272.6 million, with an additional US$114.1 million spent on managing SO2 emissions from existing smelting operations.

The entire SO2 abatement project will manage both current and expanded smelter facilities at Zimplats, with spending divided between expansion and SIB capital. The new furnace will increase smelting capacity from 135 000 metric tonnes of concentrate (equivalent to approximately 535 000 oz 6E in converter matte) to approximately 380 000 metric tonnes of concentrate (equivalent to 1.1 million 6E oz of converter matte).

Zimplats further stated that throughout the year, US$15 million was spent on the project to refurbish the SMC Base Metal Refinery (BMR), bringing the project-to-date investment to US$28.4 million against a project budget of US$190 million.

During fiscal year 2024, the company’s financial performance suffered significantly, owing principally to a major drop in metal prices. Despite a minor gain in 6E sales volumes, overall revenue fell by 20% from the previous year.

Rising costs, caused by inflation, increased output, and devaluation, further eroded profit margins. The decline in metal prices harmed the overall financial performance even though cost-cutting initiatives and increased output helped to lessen the impact of inflationary pressures on operating costs.

Zimplats’ ore processing efficiency increased considerably in FY2024. The addition of a third concentrator facility, which became fully operational in the first quarter of the year, along with optimised milling procedures, resulted in a 5% increase in milled volume.

A 1% increase in milling rates across all activities further aided this. The continuous alignment of milling rates with ore supply also resulted in a 2% increase in concentrator recoveries, indicating improved ore extraction and processing capabilities.

Looking ahead, Zimplats has set ambitious goals for FY2025, focussing on production, operational efficiencies, capital projects, and growth. The company intends to meet its planned production targets and improve operational efficiency through a variety of initiatives, including increasing pillar reclamation at Rukodzi Mine and leveraging technology for process optimisation.

In terms of capital projects, Zimplats intends to finish upgrading Mupani Mine, commission a new 38 MW furnace, and begin toll smelting of third-party concentrates. Furthermore, the company will concentrate on the development and commissioning of the first phase of its 185 MWAC solar project, while ensuring that all capital expenditure projects are within approved budgets.