Money is Politics: The Lancaster independence compromise and its implications for monetary and economic development, 1979-1980

Tinashe Nyamunda

Introduction

I usually focus on 10 year intervals when examining monetary developments, but there are times when I deviate from this structure. The last two articles were divided into focusing on five year histories. This week, I will look only at one year, examining how the foundations of Zimbabwe’s political, the result of Lancaster House negotiations and the compromise, would influence of independence negotiations on monetary developments after the attainment of political independence in 1980. So important were the negotiations and what they focused on to the trajectory that money and economy would follow.

The last article focused on how the intensifying liberation struggle and negotiations for political independence affected monetary developments. Other regional geopolitical changes such as the independence of Mozambique and the shifting stance of South Africa towards Rhodesia changed the trajectory of the struggle for liberation. While others may argue that writing about money should not revolve around political developments, I am reminded to emphasise that the two are not disconnected. Trying to separate the two is one of the great fallacies of academia. The focus this week is on how the Lancaster negotiations set the scene for post-colonial monetary and economic developments.

Money and, or as, politics?

In a 2003 Review of an International Political Economy article entitled simply “Money is politics”, Jonathan Kirshner contends that a problematic focus on the market has led to the erroneous assumption that money and politics are disconnected. “The contemporary salience of enormous and influential financial markets has obscured this immutable political reality,” Kirshner argues, “by leaving the impression that money transcends politics, and render political conflicts moot”. On the contrary, the “management of money is always and everywhere politics”, Kirshner argues, “for every policy choice, there is an alternative that some actors would prefer”. Supporting this discourse is large body of scholarship which includes scholars such Eric Helleiner, David Graeber, Geoffrey Ingham and others. Interested readers are encouraged to look up some of these scholars.

The colonial monetary system, as previous articles in this series, from the very first have labored to demonstrate, was established on the basis of political and economic interests of the British Empire. However, I demonstrated that Southern Rhodesia would be examined, not just within the context of direct imperial-colonial connections but by contextualising the colony as part of an empire wide political and economic network. I noted the observations of such scholars as Antony Hopkins, that, “the interests of leading Western nations lay in ensuring that the currencies engaged in international trade were soundly based, readily convertible, and otherwise compatible with the workings of the gold standard so that world commerce could be conducted and expanded with smooth efficiency”.

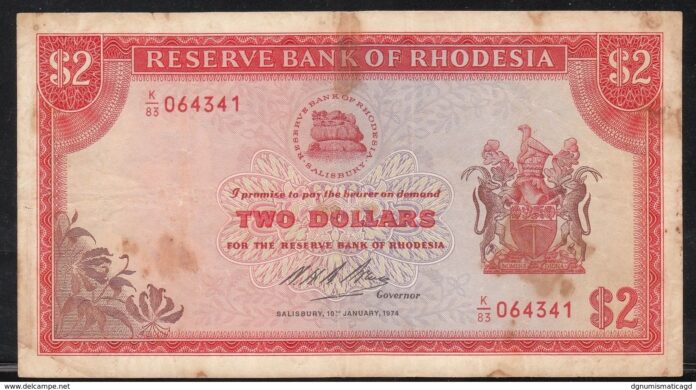

However, in that first article, I argued that “currency compatibility with the West did not necessarily translate into local stability and benefit for African communities in the local colonial economy. If anything, it resulted in the subjugation of indigenous exchange traditions and their displacement by an exploitative settler economy.” Ultimately, the imperial economic prerogatives resulted in the issuance of sterling-linked currency in British colonies, including colonial Zimbabwe until the post-Second World War period. For Rhodesia, the link survived until its expulsion from the sterling area in 1965 following the colonial Rhodesian front government’s rebellion against London through the Unilateral Declaration of Independence (UDI).

I also followed the trajectory of political economic developments, examining two important points.

1. That local white settlers wanted to abrogate to themselves the right to steer the political and economic course of the colony. Through a number of policies, the most instructive of which was the Land Apportionment Act (1930) which laid the solid foundations of structural and systemic racism that allocated the positive balance of economic rewards to the minority white population despite an uneasy accommodation with British imperialism. After the Second World War, American liberalism shifted colonial relations and allowed the settler population to build the momentum that manifested in their rebellion and UDI, and their efforts to defend the politically attained position at the top of the country’s food chain.

2. The post-Second World War global shift of power from Britain to the United States of America and with it, the shift of the global anchor currency from sterling towards the US dollar. This informed the trajectory of economic planning in Southern Rhodesia, and in some ways, allowed the rebellious Rhodesian economy to survive the expulsion from sterling by, as David Rowe has observed, manipulation the new liberal global market in ways that benefited the colony. But connected to these changes, as I observed in previous articles, is the ways in which the emergence of the System of National Accounting (SNA) and its connections with the United Nations globalism resulted in neo-colonial relations as territorial colonialism was succeeded by, to borrow John Gallagher and Ronald Robinson’s phrase, the “imperialism of free trade”. While Robinson and Gallagher used this to discuss British expansion and built upon it in their 1961 book Africa and the Victorians, I use it differently, examining instead, the ways in which the post-Second World War changes gave the phrase a whole new meaning. Scholars such as Sabelo J Ndlovu Gatsheni have demonstrated that many African countries have found themselves, despite unshackling themselves from territorial colonialism, still subjects of Euro-American imperialism whereby they are subject to financial and economic imperialism. Like many other independent African countries, Zimbabwe became part of this new reality as a result of its compromise at Lancaster with imperial and colonial interests.

The Lancaster negotiations and their outcomes: Did they yield monetary and economic independence?

I will not exhaust the discussions at Lancaster House as this has been examined elsewhere and many of the debates are not unknown in Zimbabwean history. But I will focus on their monetary and economic implications. What is clear in the Lancaster discussions was that there was far more focus on the political than there was on the economic, specifically, monetary developments.

To be clear, in all 47 plenary sessions of the Lancaster House conference that took place between 10 September and 15 December 1979, financial matters were not debated in any significant way. On the broader economic front, the sticky point was the question of property rights, especially pertaining to Land. While the African nationalists negotiating party hoped to get an agreement that gave them the authority to redistribute land as they wished, this would have summarily deconstructed the magna carta of white rule, the Land Apportionment Act. In many ways, this would have allowed for a radical transformation of racial, political, but even more importantly, economic relations in Zimbabwe. But we will return to this point after discussing the implications of silences over monetary changes.

From the research I undertook at the Bank of England and information derived from the Smith papers, I never came across any substantial negotiations over the question of money. But on the side-lines of the Lancaster negotiations, the Rhodesian Minister of Finance, David Smith, met Bank of England officials to discuss debt repayment by the new Zimbabwean government that would take over power but never consulted any of the nationalists to discuss financial issues.

The Lancaster conference led to a cease-fire for all parties. Prior to the April 1980 elections, the parties agreed to:

(a) accept the authority of the [British appointed] Governor [Lord Soames];

(b) abide by the Independence Constitution;

(c) comply with pre-independence arrangements;

(d) abide by the cease-fire agreement;

(e)campaign peacefully without intimidation;

(f) renounce the use of force for political ends;

(g) accept the outcome of the elections and instruct the forces under their authority to do the same.

Britain was conscious about recovering its debt owed by Rhodesia since UDI. However, the constitution was clear about how the “pre-independence period should not be concerned with the remodelling of the institutions of Government”. This included financial and other economic institutions and economic frameworks laid out during the colonial period. Of course, the independent government’s only change would be that it also had to meet the minimum SNA requirements to gain access to UN membership to qualify for drawing rights at the IMF and World Bank. Without mentioning issues of previous debt and its repayment as well as other extensive financial apparatus, it ensured that a system of governance through a Consolidated Revenue Fund managed through an Appropriation Act and managed by a Minister of Finance was maintained.

All government debt owed to Britain and other international institutions that London had guaranteed on behalf of its colony, would be paid through it. In the end, the negotiations lay the foundations for Zimbabwe’s debt legacy by ensuring that the independent country inherited all of Rhodesia’s colonial debt, a situation that would result in fractures to the exchange rate and stability of the new country’s currency.

As mentioned above, discussions were held about the conditions for post-sanctions exchange controls with British authorities on the side-lines of Lancaster house negotiations. At these meetings, where African nationalists were not represented, the financial conditions for majority rule were agreed to, outside of the main political negotiations, despite their centrality to the administration of Zimbabwe at its attainment of independence. In the end, the country would inherit a crippling debt of some R$700 million. Money issues were relegated to side discussions in spite of having historically determined imperial-colonial relationships since 1890, as well as being central to financing the Rhodesian rebellion between 1965 and 1979. Surely, the system had been designed for the benefit of the colonial state’s white constituency and needed redress if it were to be transformed to cater for the majority of black Zimbabweans represented by the African nationalists at Lancaster.

Indeed, among the main conditions for the lifting of sanctions against Rhodesia, was cooperation on the Rhodesian debt issue. As this was agreed, discussions turned to whether debt would have to be rescheduled and to what period. Although London held frozen Rhodesian funds at the Bank of England and had invested that which was held at the Federal Reserve, funds in other European countries were also frozen. But this would not only be insufficient to cover what it and other international lateral lending institutions were owed, and it would be seen as illegal to make claims on these funds. Upon a return to legality, the funds would be restored to the Rhodesian government and its reserve bank would have to make arrangements to resume debt servicing. However, given the impact of the war, Rhodesia was financially devastated.

To discuss debt servicing, officials from the Bank of England, in particular, Ian Plenderleith, proposed that debts be paid on their due dates from a suspense account which he assumed Rhodesia had been keeping to service foreign debts following a settlement. Plenderleith invited David Smith, the Rhodesian Minister of Finance to discuss the issue, hoping that Rhodesia would be able to make immediate payments on full arrears of capital plus interest on debt owed since UDI, but this proved to be difficult to determine given the ongoing discussions at Lancaster.

In a further meeting to engage the Rhodesians on the debt issue, Derek Day of the Commonwealth and Foreign Office organised a luncheon with Rhodesian Finance Minister, David Smith and an official from the British treasury department, John Slater. Day sought an ‘off-the-record discussion with Smith about how his side saw the future arrangements for the acceptance of debt and recommencing of servicing’. Note that all these discussions took place without involving any African nationalist negotiators. تعليم البوكر However, Smith indicated that his government had always considered debt repayment following a settlement, noting that “funds had been set aside in their books to meet arrears in favour of UK creditors”.

But these funds were denominated in Rhodesian$ without taking account of changes that had taken place since UDI, particularly the shift from sterling connections towards floating. As such, the Rhodesian government had never set aside a foreign exchange equivalent “so that when it came to the question of making payments they would need financial assistance from abroad”, although Smith guaranteed that “given a reasonable opportunity to set the wheels of recovery in motion, they could service pre UDI foreign debt” and that “it was a matter of priority that the new Zimbabwe should deal favourably with the bondholders”. Smith made guarantees without approval from some of the parties to the Lancaster House negotiations.

Following his meeting with Day and Slater, Smith arranged for his Permanent Secretary, David Young to attend official discussions about exchange control between Rhodesian and Britain hosted by the Bank of England, including Zimbabwe’s international debt repayment schedule. The value of London market debt constituted £48.6 million outstanding of principal and interest on pre-UDI stocks past their redemption date, £25.3 million of interest and unpaid Sinking Fund contributions not yet matured, as well as IBRD and ECGD guarantees of £54 million. In addition to these debts, the new government inherited a war ravaged economy. جوائز كريستيانو رونالدو

As the Lancaster negotiations proceeded, London had removed all major exchange controls that had been part of its financial system since 1947. Although aware that its controls had become obsolete, but with regards to Rhodesia, “Exchange Controls needed to maintain economic sanctions are being kept” pending a final settlement.

Meanwhile, Young, the Ministry of Finance Permanent Secretary worked with British officials on post settlement exchange control arrangements. Compiled on the day the conference ended on 15 December 1979, the dossier to dismantle financial and economic sanctions was designed “within the context that UDI will end as a result of political recognition in which the previous financial order is restored in something like its old form”. The dossier also included an account of all investments made with Rhodesia money in the British and USA financial markets to the extent of US$500.000 and other bondholders dent. However, a lot had changed since 1965. Unsurprisingly, any ‘old form’ of monetary connections had become extinct. London’s 1947 Exchange Control Act which had operated in its remaining post-Second World War empire had been abolished in 1971. During UDI, Rhodesia had established a territorial exchange control machinery. Moreover, Rhodesia had also diversified its trade significantly and overcome any colonial economic dependency it had on Britain.

The real object behind Euro-American and white Rhodesian interests was to safeguard their collective interests to a significant degree. For the Patriotic Front nationalists, as Nkomo aptly captured in the his opening speech at Lancaster, their objective was to “leave no stone unturned in our struggle for the total liquidation of colonialism in Zimbabwe”. But the basis of the white settler agreement was that anchored on the ideal that came to be contained in the ultimate Lancaster House constitution’s clauses on “freedom from deprivation of property” for at least the first ten years of independence. The clause accepted the principle of the “protection for privacy of home and other properties”. This stipulation prevented any incoming government from legally making any radical transformation of the economy.

Even if the Patriotic Front rejected this property clause which in many ways upheld and technically extended the magna carta of white economic superiority, they were eventually pressured into accepting it as their allies in the region, Mozambican leaders Samora Machel and Zambian leader Kenneth Kaunda had paid a heavy price for supporting Zimbabwe’s liberation struggle and were not prepared to see its continuation. Ultimately, this was the price the African nationalists and their backerswere forced to pay. . Reflecting on this Lancaster constitution in his book, A Story of my Life, years later, Joshua Nkomo complained that the constitution was “a result of muddle and compromise, reached in haste in order to stop the bloodshed”. I argue that accepting the compromise resulted, as Christine Sylvester observed in her book: Zimbabwe: A Terrain of Contradictory Development, in Zimbabwe’s economic “reconciliation with Rhodesia”. Africans were unfairly offered “the driver’s seat [whereas] whites would continue to map the route the car must take and control the fuel which made it run”, setting the scene for revived economic tension in the later postcolonial period.

Based on this settlement, all remaining exchange controls against Rhodesia were lifted at midnight 12 December 1979. They were lifted through the Southern Rhodesia Revocation Order (1979). بطولات الليفر The passing of the Order was designed in such a way that “[t]he complete obligation of exchange control thus becomes worldwide”, following which all UN member countries would follow suit. Thereafter, Rhodesia (on the brink of becoming Zimbabwe) was admitted into the community of nations as a British colony prior to the election whose results announced Zimbabwe African National Union (Patriotic Front)’s Robert Mugabe as the country’s first Prime Minister. He chose his first government on 18 April 1980 as Rhodesia transformed from a colony into becoming Zimbabwe. But as we shall see in the next article, his choice of economic ministers would be a certain kind of technocrat that would steer the country away from any radical economic transformation.

Conclusion

I hope the article went some way in demonstrating the extent to which money and politics are not disconnected. If anything, the Lancaster House negotiations avoided discussing pivotal currency and financial issues, yet behind the scenes, they were subjected to settler and British negotiations. Connected to currency issues were other economic considerations such as the land issue which was a sticky point. But whereas the conclusion on the land issue, and by extension, property rights, was unsatisfactory, the silence on currency and financial aspects of the compromise is very strange. This is especially because these two aspects were crucial to the country’s post-colonial development. The white Rhodesian politicians, the British and Americans had their pulse on this crucial issue that would ensure that Zimbabwe did not deviate from norms of the SNA trap and the economic interests of whites and foreign investors were protected. These issues will be unpacked and further explored as we examine how they determined the new government’s implementation of policy in the next article. Clearly then, politics was central to monetary and economic developments in post-colonial Zimbabwe, just as money came to influence the behaviour of politicians in the country also, as we shall discover.

• Tinashe Nyamunda is in the African Modernities Past and Present Research Group at North West University (South Africa) where he is Associate Professor of Economic History

You never disappoint Prof. Very good article