Rhys Balicholo

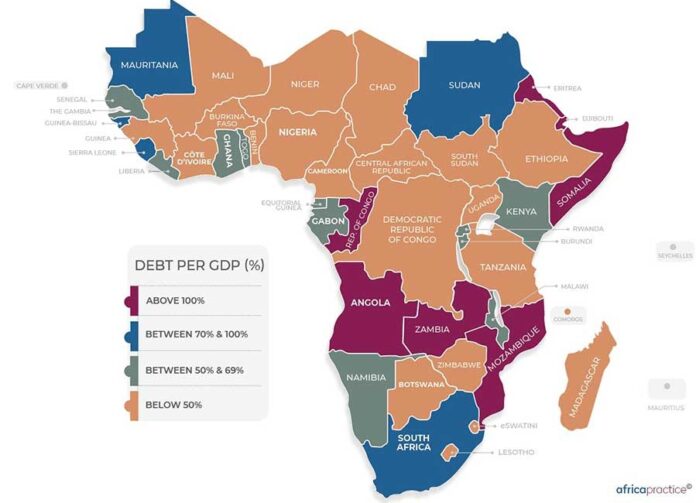

HARARE – The high levels of debt in African countries are slowing down the development of the economy where seven countries, Zimbabwe included, have a debt to GDP ratio which is above 100.

In fact, the continent’s combined debt-to-GDP ratio in 2020 reached its highest level in two decades. Contained within this concerning overall picture lie even more worrying cases, such as Zambia, which became the first country to default on its debt during COVID-19 late last year.

Since 2015, African governments have taken a lot more debt and what is more worrying is that rather than on concessional terms, a lot of that debt has been sourced from international markets and are foreign currency denominated.

When Covid-19 hit, the governments were struggling on debt repayments. Seven countries including Zimbabwe have a debt to GDP ratio at or more than 100% and it is estimated that 48 out of 53 countries have a debt to GDP ratio of above 40% which is above threshold as encouraged by the IMF for developing economies. lovely lilith viagra falls 3

During the Launch of the 2021 Edition of Africa Risk-Reward Index Senior Analyst of Control Risk Patricia Rodrigues said: “governments have responded to this by taking on help where it is offered, for example from the G20s to look for debt suspension Debt Services Suspension Initiative (DSSI) which has come at a great cost.”

Ethiopia was the first country to take on the debt cancellation, however, it put its sovereignty on the line and it was almost downgraded immediately after they approached DSSI.

“Paradoxically other countries have addressed this issue by taking more debt in order to cover previous debts so we have had Euro 9 bond issues since the beginning of the pandemic.’’

According to François Conradie, Lead Political Economist at Oxford Economics Africa:

“Africa’s debt burden has grown massively heavier over the past 18 months, as governments have borrowed to finance both their health response to Covid-19 and stimulus measures meant to lessen the pandemic’s economic impact. The current low interest rate environment makes the debt look manageable, but now the US Fed has made explicit that the countdown to tapering off monetary stimulus has begun. When central bankers worldwide start pushing up their rates, African governments will be faced with questions that have no easy answers.”

Rodrigues said the obligation of servicing debt will put strain on state-owned enterprises and will tend to limit opportunities for private-sector companies that do business with government. Options for restructuring or paying down this debt are limited, yet some innovative solutions are being discussed and tested. New social bonds and regional funding mechanisms will not offer a quick-fix substitute for sound fiscal management but can help reduce the threat such debts pose and offer new opportunities for investors.

The Africa Risk-Reward Index is defined by the combination of risk and reward scores, integrating economic and political risk analysis by Control Risks and Oxford Economics Africa.

Risk scores from each country originate from the Economic and Political Risk Evaluator (EPRE), while the reward scores incorporate medium-term economic growth forecasts, economic size, economic structure, and demographics.

Rodrigues says they have seen governments do what has been done traditionally elsewhere but not in Africa, where they set aside funds known as sinking funds within their budgets to make sure they have money to back their public debts.

‘’We have also seen what is known as asset swaps for example in Namibia and Northern economies where they are using their sovereign funds in the economy to try and get domestic currency funds to acquire foreign currency denominated assets’’

Another interesting thing she highlighted was that African governments decided to build back better from the pandemic where they are now developing towards Sustainable Development Goals (SDGs) which seeks to finance social development projects for example Ghana which is going to be issuing a bond to finance environmental and social development.

African countries are now focusing much more on multilateral union such as African Union with the UN economic commission for Africa looking to set up multilateral support to fund sustainable economic development.

She urged investors not to overlook the issue of debt payments because in the coming year there is likely to be debt payment delays because governments really need to service these debts but encouraged them to look beyond was is currently happening to avoid them missing out on good investment opportunities.

The Control Risks encouraged Africa to shift towards domestic borrowing because it necessitates capital markets which will open new funding paths for the private sector.

African governments must also reduce the desire to rely on foreign currency which caused foreign currency denominated debts.