HARARE – Despite the recent strengthening of the South African rand against a generally weakening dollar, street dealers have not adjusted quotes and are maintaining the 15.50-16 trading range, taking advantage of the festive-season induced demand. The rand is currently trading at 14.89 against the US dollar (as of December 15 prices).

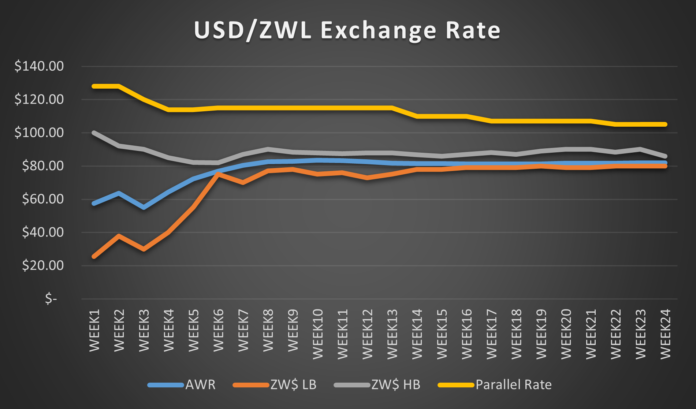

Street rates remain firm within the 108-115 range with volume buyers mostly seen at small traders and individual levels while on the official market, the local currency gained a marginal 0.1473% to 81.7368 from 81.8572 attained last week at the Reserve Bank of Zimbabwe auction system.

Bids came in high at 485 as most companies made their final bids for the year before entering closed period this Friday. A total of US$31.9m – the third highest to date – was apportioned to both the Main Auction (US$29.5m) and SMEs (US$2.4m). 50 bids were rejected. Highest and lowest allotted bids remained unchanged at 86 and 80 respectively. Likewise, the spread between bids remained at 7.50%.

The difference in the average weighted rate and the highest bid widened this week as it came in at 5.39% from 4.82% of the previous auction. The difference between the parallel market rate and the weighted average rate remained flat at 22.02%.

Raw materials continued to receive the highest allocation at US$16.1 mln, Machinery and Equipment US$6.3 mln, Consumables US$2.10 mln, Services $2.2mln, Retail and Distribution $2.5mln Pharmaceuticals US$2 mln. Other amounts below US$2 mln were allotted to, Chemicals Fuel, Electricity and Gas, Paper and Packaging.

Meanwhile, the US dollar languished near 2 1/2-year lows as progress toward a massive U.S. government spending bill and Covid-19 relief measures whetted risk appetite, sapping demand for the safest assets. The dollar index, which measures the greenback against a basket of currencies, was last at 90.477, after sinking as low as 90.419 on Monday, a level not seen since April 2018.

Cryptocurrencies are facing value reverse as they saw heavy losses on Tuesday as some traders are cashing in and going to Asia as it is seen as the growth continent of Q1 2021. As a result Bitcoin lost 1.47% to $18 896.75. Ethereum and Bitcoin Cash also saw a day of losses on the market with the former shedding 2.09% to 577.82 whilst the latter closed 2.89% weaker at $275.57.

| Street Rates | Bond | Mobile Money | ||||

| US$ | Buying | Selling | Daily Change | Buying | Selling | Daily Change |

| Eastgate | 75 | 85 | 0% | 87 | 98 | 0% |

| Copa Cabana | 75 | 85 | 0% | 87 | 98 | 0% |

| Market Square | 76 | 85 | 0% | 87 | 98 | 0% |

| Rand ZAR | Buying

US$ |

Selling

US$ |

Daily Change | Buying | Selling | Daily Change |

| Market Square | – | 15.5 | 0% | – | – | 0% |

| Eastgate | – | 16 | 0% | – | – | 0% |

| Roadport | – | 16 | 0% | – | – | 0% |

| Malawi HBEI | 770 | ||||

| Mozambique HBEI | 70 | ||||

| Zambia | 21 | ||||

| DRC | 2100 | ||||

| HBEI Zim | 105 | ||||

| OMIR | – | ||||

| November | October | ||||

| CPI | 2,374.24 | 2,301.67 | |||

| Monthly Inflation | 3.15% | 4.37% | |||

| Annual Inflation | 401.66% | 471.25% | |||

| Crypto-Currencies (US$) | |||||

| Bitcoin | $18,896.75 | ||||

| Ethereum | $577.82 | ||||

| Bitcoin Cash | $275.57 | ||||

| Fixed Deposit Rates (RTG$) | |||||

| 30 Days | 60 Days | 90 Days | 180 Days | 360 Days | |

| CBZ | 5.0% | 5.5% | 6.0% | 6.5% | 6.5% |

| EcoBank | 4.5% | 5.0% | 5.5% | – | – |

| Nedbank | 4.6% | 5.0% | 5.2% | 5.5% | 6.0% |

| NMB | 5.2% | 5.5% | 6.0% | – | – |

| Steward | 4.0% | 5.0% | 5.4% | 5.7% | 6.0% |