Talkmore Gandiwa

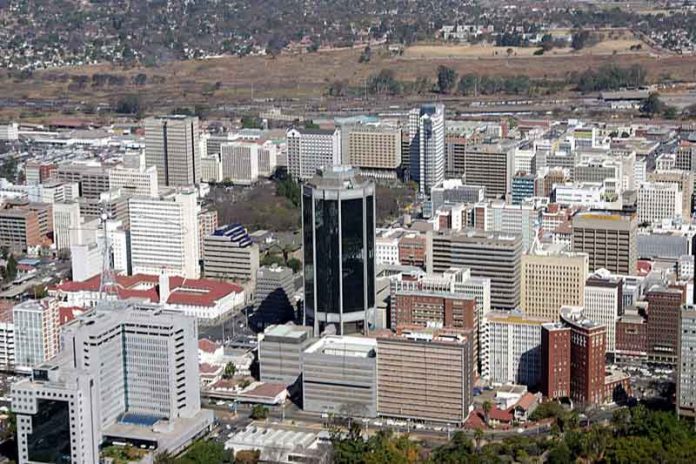

HARARE – Zimbabwe has signed a double taxation agreement with Switzerland to eliminate double taxation and prevent tax evasion in a development expected to enhance economic cooperation and attract cross-border investments between the two nations.

According to Zimra the country loses an estimated amount of over US$ 1.5 billion annually to illicit financial flows through tax evasion, smuggling and money laundering.

Finance, Economic Development and Investment Promotion Minister Mthuli Ncube said that the agreement embodies the key principles of ensuring that companies investing in both contracting parties’ economies contribute fairly to government revenue, while authorities ensure that income is already taxed in Zimbabwe.

“This treatment is important in encouraging cross-border investment, promises clear treatment of income such as dividends, management fees, royalties and remuneration, amongst others,” said Ncube.

The complexity of cross-border trade and the rise of e-commerce requires fiscal authorities to strengthen tax systems and agreements, addressing potential loopholes. The contracting parties recognise the challenges of the digital economy.

The agreement aims to prevent treaty shopping, where third-party taxpayers exploit tax residency rules to gain unfair benefits. The entitlements-to-benefits clause is a key measure to protect domestic resource mobilisation.

Ncube said, contracting parties should go beyond the Article 25 provisions of the signed agreement and ensure effective and efficient exchange of information upon request and automatic exchange of information with a view to combat aggressive tax avoidance, tax evasion and illicit financial frauds.

“I’m confident that this event will unlock investment opportunities that were previously curtailed by the lack of a clear framework for the taxation of cross-border income,” said Ncube.

Swiss Federation Ambassador Stephan Rey said the bilateral agreements against double taxation play a crucial role in facilitating international economic relations while protecting taxpayers’ rights.

“By reducing the risk of double taxation, these treaties promote international investment and trade. (1:05) Businesses and individuals are more likely to invest in a country if they know they will not suffer from double taxation. So, I’m very optimistic that this DTA will contribute to a stronger and more prosperous future for both our nations,” said Rey.

Permanent secretary George Guvamatanga said the tax treaty will pave the way for the enhancement of investment, in particular through the eminent establishment of companies, which is key to the growth of the economy.