Itai Ndongwe

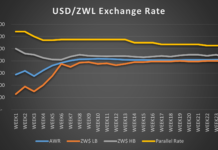

HARARE – Choppies said it is keeping close tabs on conditions in the Zimbabwean market since hyperinflation is wreaking havoc on the data on a continual basis, causing growth to stagnate.

Disposable income growth would remain below anticipated inflation for each year of the medium-term forecast period, reflecting Zimbabwe’s precarious consumer situation. As a result, Zimbabwean households are projected to continue to face a number of difficulties that have a significant impact on expenditure, including triple-digit inflation and decreasing remittance inflows from South Africa and the United Kingdom.As a result, Zimbabwean consumers will continue to be price sensitive, shifting their spending to lower-cost alternatives and the informal economy.

According to the company’s financials, Zimbabwe’s EBITDA fell 108.1% to BWP3 million loss, compared to BWP37 million profit in 2022, due to the economy’s difficulties.

Despite the problems, Choppies appears committed to the Zimbabwean market, as the report states that the company is “keeping a close eye on conditions in the country,” implying that they are monitoring the economic situation and may be searching for ways to enhance their performance.

During the period under review, one new store opened in Zimbabwe, and Choppies performed satisfactorily, despite the fact that its profitability was impacted by Zimbabwean problems. However, it reported an increase in stores and income in Botswana, Zambia, and Namibia.Choppies is Southern Africa’s largest retailer outside of South Africa, with 177 outlets in Botswana, Zimbabwe, Zambia, and Namibia, as well as 10 distribution hubs.